Identity Theft Insurance: What It Covers and What It Doesn’t

In today’s digital age, protecting your personal information has never been more important. With the rise of online transactions and the increasing sophistication of cybercriminals, identity theft has become a prevalent issue. One effective way to safeguard your personal information is by investing in an identity theft protection insurance policy. In this article, we will explore what identity theft insurance covers and what it doesn’t, and highlight the importance of buying insurance online.

What Identity Theft Insurance Covers

Identity theft insurance typically covers the following:

- Legal Fees: If you become a victim of identity theft, identity theft insurance can help cover the costs of legal representation to help resolve the issue.

- Lost Wages: If you need to take time off work to resolve identity theft issues, identity theft insurance can help reimburse you for lost wages.

- Credit Monitoring: Many identity theft insurance policies include credit monitoring services to help you detect any suspicious activity on your credit report.

- Identity Restoration: Identity theft insurance can provide access to specialists who can help you restore your identity and credit.

- Travel Expenses: If you need to travel to resolve identity theft issues, identity theft insurance can help cover the costs of travel expenses.

What Identity Theft Insurance Doesn’t Cover

Identity theft insurance typically doesn’t cover the following:

- Stolen Money: Identity theft insurance doesn’t cover the money stolen from your accounts as a result of identity theft.

- Personal Property Damage: Identity theft insurance doesn’t cover damage to your personal property, such as a stolen laptop.

- Criminal or Intentional Acts: Identity theft insurance doesn’t cover criminal or intentional acts committed by the policyholder.

- Liability You Assume Under Contract: Identity theft insurance doesn’t cover liability you assume under a contract, such as a contract with a credit card company.

Why Buy Insurance Online?

Buying insurance online offers numerous benefits, including:

- Convenience: You can purchase a policy from the comfort of your own home, without the need for appointments or in-person meetings.

- Comparison: Online platforms allow you to easily compare different policies and companies, helping you find the best deal for your needs.

- Transparency: Online policies often provide detailed information about coverage, terms, and conditions, making it easier to understand what you are purchasing.

If you’re based in Kenya, it’s essential to research and compare the insurance companies available in your country. Look for reputable companies with a strong track record in providing identity theft protection insurance.

In conclusion, identity theft insurance can be a valuable tool in safeguarding your personal information. By understanding what identity theft insurance covers and what it doesn’t, you can make an informed decision about whether this type of insurance is right for you. Remember to buy insurance online to ensure a smooth and hassle-free experience.

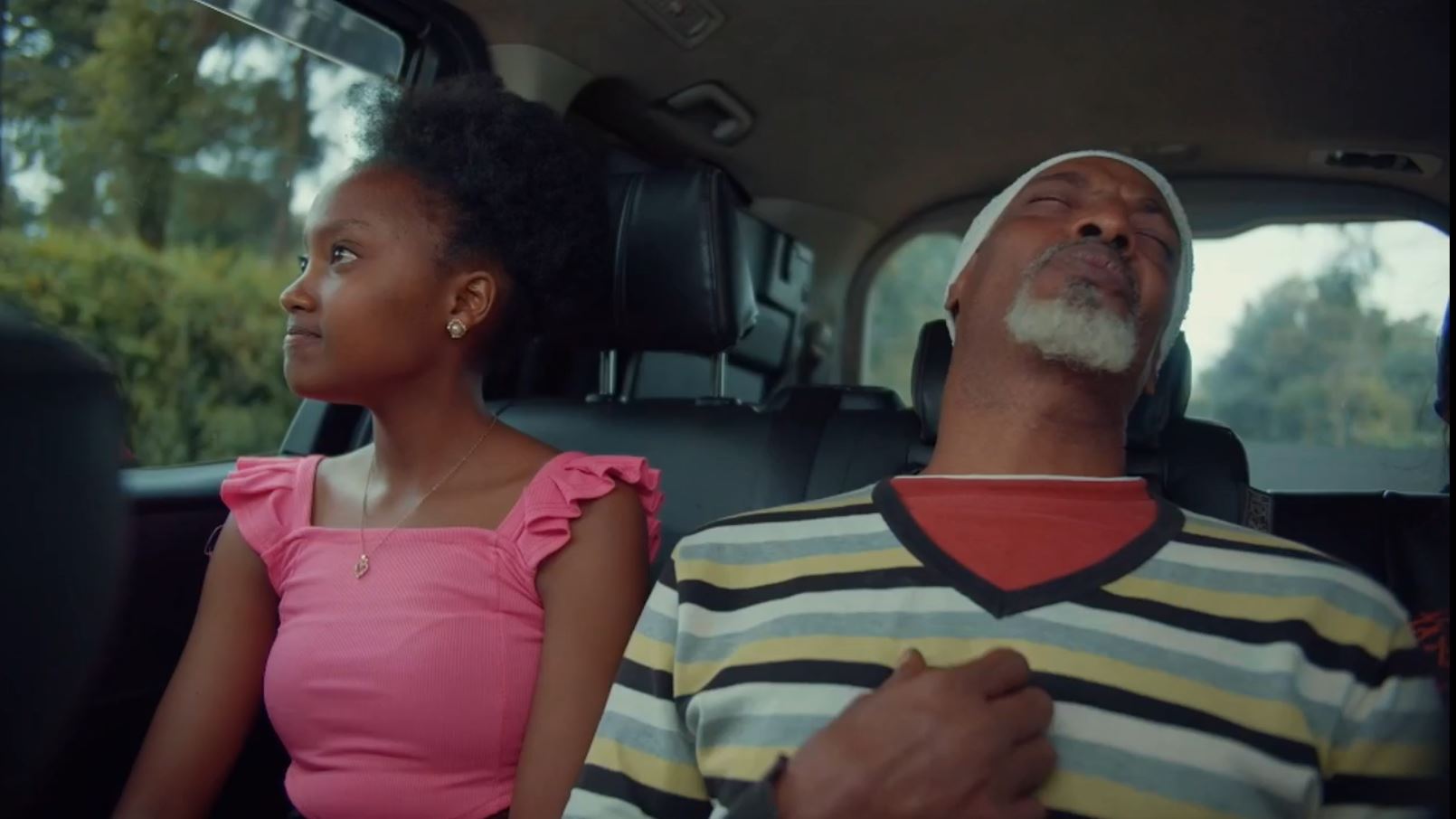

NEEMA CITIZEN TV TUESDAY 23RD JULY 2024 FULL EPISODE PART 1 AND PART 2 COMBINED

You must be logged in to post a comment.