Navigating Insurance Claims with Good Faith: A Comprehensive Guide

In an era where convenience is king, more individuals are opting to buy insurance online for its ease and efficiency. However, what happens when you need to file a claim? This article delves into the concept of good faith in insurance claims, a principle that’s crucial for both policyholders and insurance companies.

Understanding Good Faith

Good faith, or “uberrimae fidei,” is a fundamental principle in insurance law, requiring both parties in an insurance contract to act honestly and fairly. For policyholders, this means providing accurate information when purchasing insurance and when making a claim. For insurers, it involves fairly assessing claims and not unreasonably denying them.

- Policyholders’ Responsibilities: When you buy insurance online or through any other means, you must disclose all relevant information. This includes details about your health, lifestyle, or any previous claims. Misrepresentation or omission can lead to claim denials.

- Insurers’ Responsibilities: Insurance companies must investigate claims thoroughly but should not delay or deny claims without justifiable reasons. They’re expected to communicate clearly about what’s needed for a claim to proceed.

The Role of Insurance Companies in Kenya

When discussing insurance claims, it’s worth mentioning insurance companies in Kenya, where the insurance market has seen both growth and challenges. Companies like Britam, CIC, and Jubilee Insurance are pivotal in providing various insurance products. Here, the principle of good faith is equally applicable:

- Local Practices: Kenyan insurers often engage with policyholders through local agents or online platforms, emphasizing the need for transparency. Claims processes might differ, but the expectation of good faith remains constant.

- Challenges: There have been instances where policyholders feel that claims are not handled in good faith, leading to disputes. This underscores the importance of clear communication and adherence to legal standards by insurers.

Handling Claims with Good Faith

- Documentation: Always keep detailed records of your interactions with your insurance provider, including emails, call logs, and any correspondence about your claim.

- Transparency: If you’re unsure about any information, seek clarification before providing it. Misunderstandings can lead to claims being processed in bad faith.

- Legal Recourse: If you believe your claim has been unfairly denied, consider legal advice. In Kenya, as elsewhere, there are regulatory bodies that oversee insurance practices.

Conclusion

The relationship between an insurer and a policyholder should be built on trust and transparency, encapsulated in the principle of good faith. Whether you’re looking to buy insurance online or dealing with a claim, understanding this principle can make the process smoother and more equitable. Remember, good faith isn’t just a legal requirement; it’s the foundation of a fair insurance system where both parties benefit from clear, honest dealings.

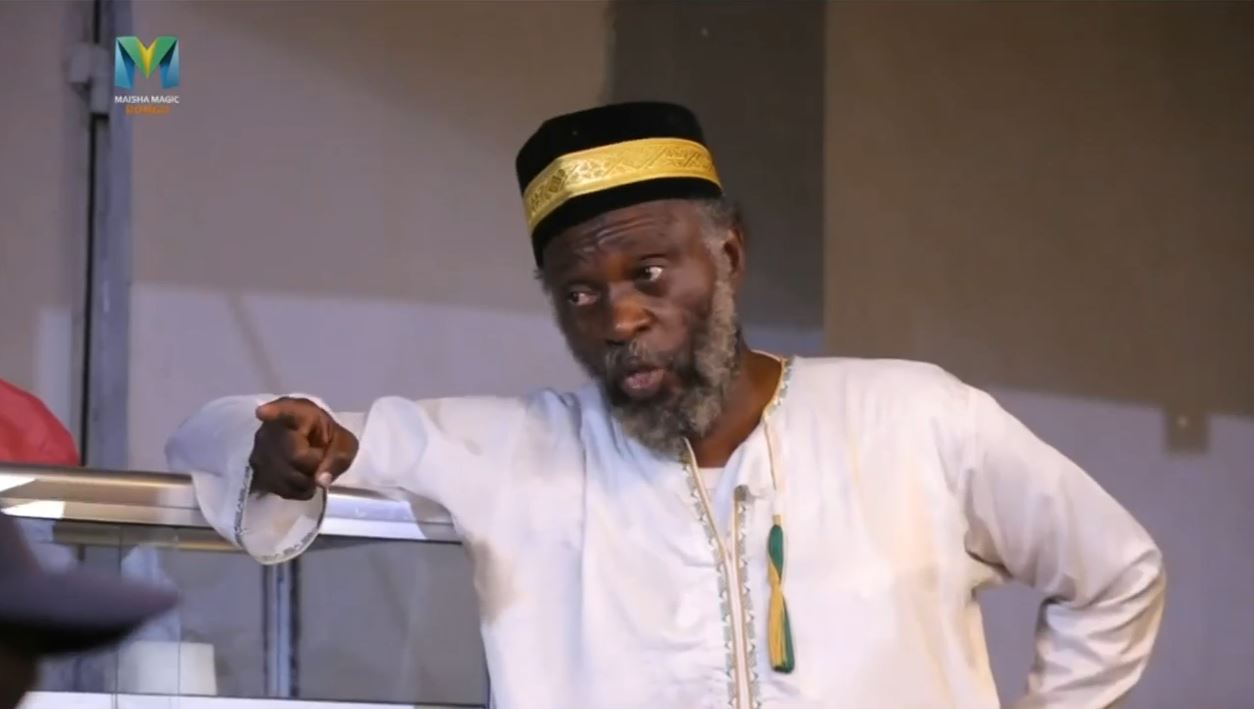

HUBA JUMATANO LEO USIKU MAISHA MAGIC BONGO SEASON 13 EPISODE 102 21ST AUGUST 2024 FULL EPISODE

You must be logged in to post a comment.