Navigating the World of Term Life Insurance: A Comprehensive Guide for Kenyans

Introduction: When it comes to securing the financial future of your loved ones, term life insurance is an essential tool that can provide peace of mind and protection in times of uncertainty. In this article, we will explore the ins and outs of term life insurance, its benefits, and how you can find the best insurance companies in Kenya to buy an insurance cover that suits your needs.

What is Term Life Insurance? Term life insurance is a type of life insurance policy that provides coverage for a specific period, typically ranging from 10 to 30 years. Unlike whole life insurance, which covers you for your entire life, term life insurance is designed to protect your loved ones financially in the event of your untimely death during the specified term.

Benefits of Term Life Insurance:

- Affordability: Term life insurance policies are generally more affordable than other types of life insurance, making it a popular choice for individuals and families on a budget.

- Flexibility: With term life insurance, you can choose the duration of coverage that best fits your needs and budget.

- Financial Protection: In the event of your death, the death benefit from a term life insurance policy can help your family cover expenses such as funeral costs, outstanding debts, and daily living expenses.

- Tax-Free: The death benefit from a term life insurance policy is typically tax-free, providing your beneficiaries with the full amount of the coverage.

Finding the Best Insurance Companies in Kenya: When shopping for term life insurance, it’s essential to research and compare different insurance companies to find the best fit for your needs. Here are some factors to consider when evaluating insurance companies in Kenya:

- Reputation: Look for insurance companies with a strong reputation for customer service, financial stability, and timely claim payments.

- Coverage Options: Ensure the company offers a range of term life insurance policies with different coverage amounts and durations to meet your specific needs.

- Premiums: Compare the premiums charged by different insurance companies to find the most affordable option for your budget.

- Claims Process: Research the claims process of each insurance company to ensure it is straightforward and efficient.

Conclusion: Term life insurance is a vital tool in securing the financial future of your loved ones. By understanding the benefits of term life insurance and researching the best insurance companies in Kenya to buy insurance cover, you can make an informed decision that provides peace of mind and protection for your family. Remember to compare different policies, premiums, and coverage options to find the best fit for your needs and budget.

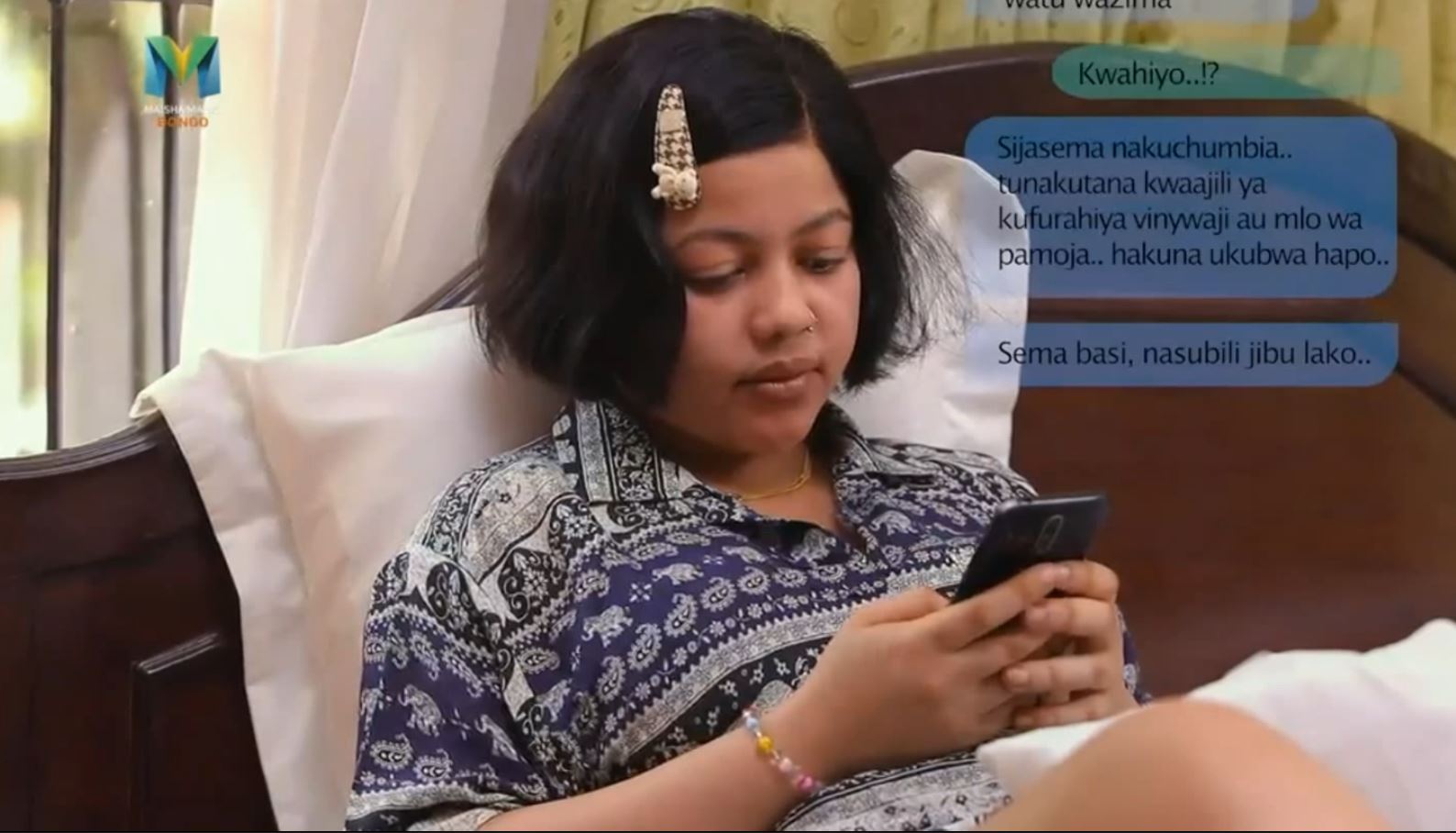

HUBA IJUMAA LEO USIKU MAISHA MAGIC BONGO SEASON 15 EPISODE 49 7TH JUNE 2024 FULL EPISODE

You must be logged in to post a comment.